You may be looking to buy a HDB resale flat and this question was posted to you, are you taking a HDB loan or a Bank loan? In today’s article, we will be exploring this topic: HDB loan versus bank loan when it comes to buying a HDB resale flat.

For a little bit of context as to why this has been a recently hotly-discussed debate, this was because the bank interest rates were trending at a very low 1 – 1.2% just last year. Compare this to the 2.6% interest rate of the HDB loan, suddenly it makes a lot more sense to take on a bank loan when purchasing a HDB resale flat. Of course interest rates have steadily climbed recently, in line with the US interest rates hike announcements as well. In this article, we will be looking at several key components such as eligibility, loan-to-value ratio, tenure, interest rates, sequence of disbursement and their main differences between a HDB loan and a bank loan.

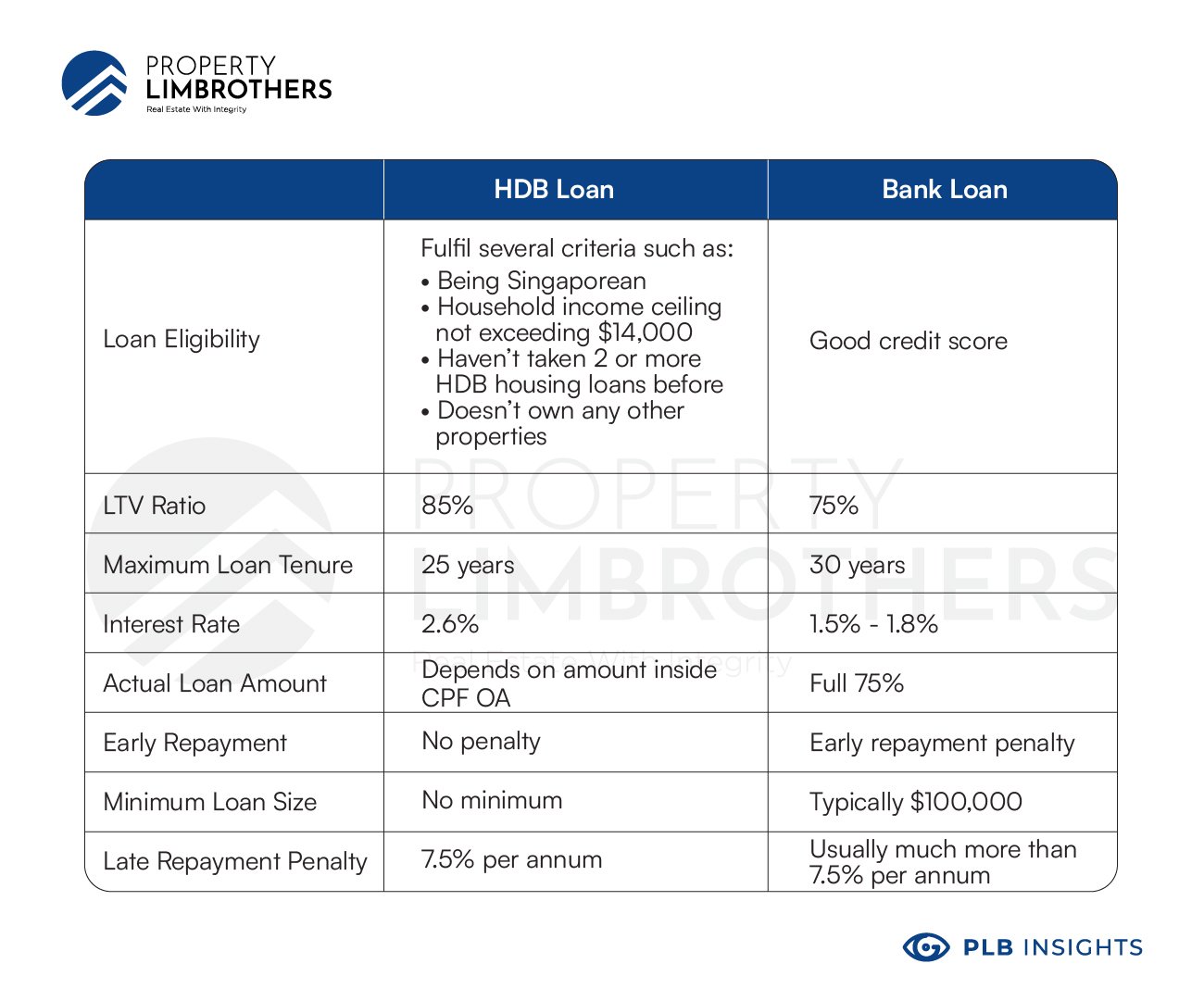

The Loan Eligibility

In terms of HDB loan eligibility, the borrowers need to fulfil several requirements. These include a household of having at least 1 Singaporean, household income ceiling of not more than $14,000, haven’t taken 2 or more housing loans from HDB before, as well as not owning any other properties locally or overseas.

On the other hand, for the application of a bank loan, as long as you haven’t been defaulting on your loans and you have a good credit score is sufficient to warrant a loan from the bank.

With regards to how much you can borrow, this will depend on your income, the total debt servicing ratio (TDSR) and the mortgage servicing ratio (MSR) restrictions framework that are put in place by the government to ensure that people do not borrow more than what they can afford.

The Loan-to-Value Ratio

Based on the latest cooling measure back in December last year, the amount of HDB loan-to-value was reduced from 90% to 85%. However, it is still 10% more than the 75% LTV that you can get from a bank loan. This essentially means that as your loan-to-value ratio for a HDB loan is at 85%, with a large portion of the payment coming from the HDB loan and CPF, your initial cash outlay will not be as high as a bank loan.

Maximum Loan Tenure

The maximum tenure for a HDB loan is 25 years. Conversely instead of 25 years, you can take up to a maximum tenure of 30 years for a bank loan. Assuming the loan amount is the same, it can mean a lower mortgage payment per month as you are given more time to pay off your housing loan, but do note that the total interest paid will be higher since it is an additional 5 years of repayment.

Interest Rate

The interest rate for the HDB loan is pegged to the current CPF OA interest rate + 0.1%. Hence, as the current CPF interest rate is 2.5%, it makes the effective rate for a HDB loan 2.6%. This interest rate has also largely remained stable vis a vis the more variable interest rates from the bank. Bank interest rates have largely hovered in the 1% – 1.3% range last year. It has now shifted slightly upwards to the range of 1.5% – 1.8%. Depending on the market conditions, bank loan rates are usually more variable. This applies to loan packages that are pegged to fixed interest rates as well. After a lock-in period of two to five years, these so-called fixed-rate home loans follow a floating rate.

Actual amount of loan and the sequence of disbursement

For the HDB loan, many people have the misconception that they will be loaning the full 85% of the valuation by choice. Actually this is not the case for most of the time. There is a particular sequence of disbursement which ultimately will then equate the amount of HDB loan that you will be undertaking.

Starting from the very beginning when you put in the downpayment consisting of the option fee as well as the exercise fee, these 2 components are purely from the cash component for a resale flat. These are typically in a $1000 (option) + $4000 (exercise) arrangement. After you have exercised the option for the purchase of the resale flat, it is mandatory to wipe out your CPF in the Ordinary Account, with the option to keep up to $20,000 per buyer in the CPF OA should you wish to. Only after all these, then the remaining balance amount will be covered by the HDB loan. If there are eligible grants for the buyers, these further reduce the amount of HDB loan that they need to take.

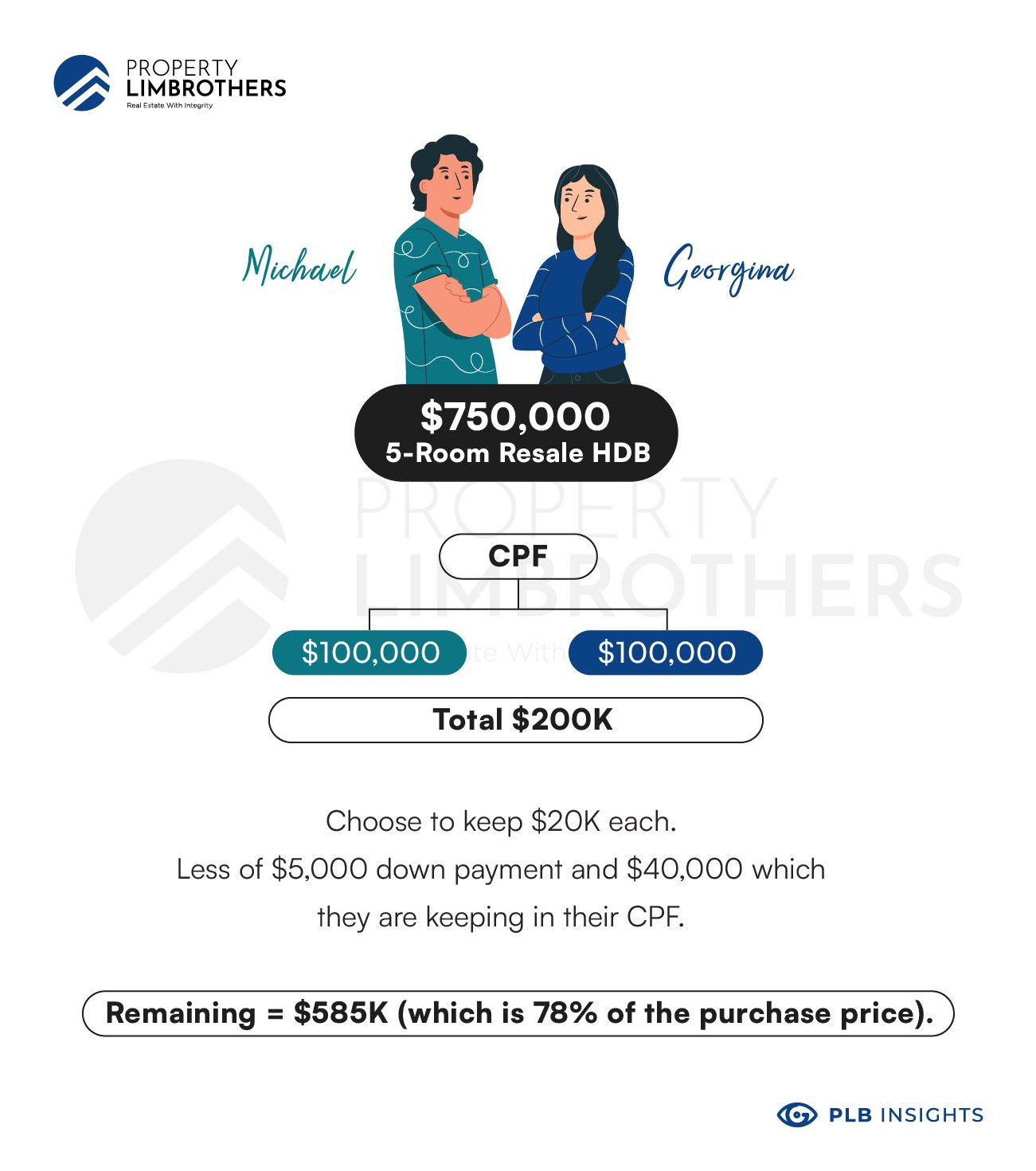

For example, let’s have this the scenario of a married couple Michael and Georgina who wish to purchase a resale 5-rm flat which costs $750,000. For simplicity sake, we assume that valuation matches.

Both of them have a combined amount of $200,000 in their CPF. They make the decision to keep the maximum of $20,000 each in their CPF OA, hence utilising $160,000 from their CPF.

After lessing off the $5,000 option and exercise fees and the $160,000 from their CPF, the remaining $585,000 which is 78% of the price will then be the amount that falls under the HDB loan. As mentioned, this is less than the maximum 85% loan-to-value ratio for a HDB loan.

For a bank loan, you can take a loan up to a maximum of 75% of the valuation. Assuming that your income meets the criteria, you will be granted the full 75% amount. Lessing off the 5% fees in cash, you will then have a choice of how much CPF or cash you wish to portion in terms of payment for the 20% balance. Some people may choose to use more cash if they deem the 2.5% interest rate which they can earn through CPF to be attractive. This also means more current available funds in CPF for their monthly mortgage payments moving forward. Alternatively, if they choose to use more CPF funds, this can then free up more cash for their other investments.

Early repayments differences

For HDB loans, if the borrower suddenly has a large sum of funds and wishes to pay off the mortgage loan, they can pay off however much they want without incurring any penalty. But for a bank loan, there is usually a penalty fee if the borrower decides to make early repayments or do a re-financing within the lock-in period.

Closing Thoughts

Although it may seem like a good thing that you can borrow more funds from a HDB loan, getting a bigger loan could mean you end up paying more interest in total. Borrowing less from a bank loan could also mean saving more in the long run. Henceforth, weighing both out, if you have the cash finances to cover the initial outlay, it makes more sense to take the bank loan due to the lower interests. However, it’s good to remember that the attractive bank loan interest rates are only locked in for three to five years, after which they tend to get more expensive. Another thing to note is that you are able to refinance from a HDB loan to a bank loan should the bank loan terms favour you, but not vice versa.

We would advise that if you want to continue maximising savings and enjoying competitive interest rates, you can consider to proactively do a refinancing each time your lock-in period ends. Do bear in mind the legal fees involved when doing a refinancing. However, if you are conservative and want to splash out less cash outlay, have less uncertainties and perhaps be more hassle-free, then take the HDB loan, but note that your CPF will be heavily utilised and you will pay a higher interest rate.

All in all, there is no right or wrong as everyone’s financial plans and life situations are different. If you’re looking for professional and easy help to finance your next home, we found that PropertyGuru Finance has comprehensive tools to help you get the best mortgage rates across all major banks. You can get objective, unbiased advice from PropertyGuru Finance mortgage experts and save more in the long run. Alternatively, should you need a more comprehensive discussion, do feel free to reach out to us here.